Comprehensive, cloud-based lending.

Improve margins, streamline workflows and deliver exceptional digital lending experiences

It’s time to replace last century’s lending processes. Today’s borrowers expect quick and easy digital experiences—and lenders need the flexibility to deploy and modify lending applications quickly. Make borrowing simple and fast for your customers with automated processes that can approve, underwrite, and fund loans in minutes—and make life easier for your staff by minimizing the rekeying of data and avoiding manual handoffs of workstreams between departments.

It’s time for your lending to move at the speed of business.

Here's how to make it happen.

SCALE YOUR LENDING EFFORTLESSLY

Transform your lending processes to build a more profitable, scalable, and responsive business.

Improve margins and operational efficiencies

Streamline your processes and decrease the friction that both your applicants and employees experience. Your lending business will become more efficient, reducing the time it takes to process and underwrite loans—increasing margins without touching rates or staff levels.

Increase scalability and revenue growth

Don’t let legacy technology limit your capacity. Use a flexible cloud-based solution to support virtually unlimited lending. With repeatable, automated loan processes, your business can handle application volumes of 3X your historic levels without adding staff or compromising lending standards.

AGILE AND SCALABLE TECHNOLOGY

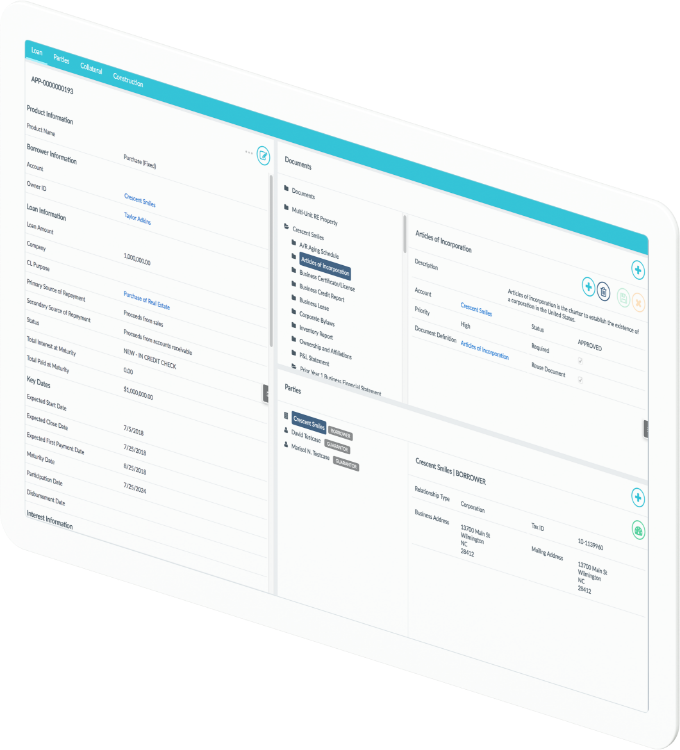

End-to-end lending from application to collections Automated and configurable workflows Native Salesforce build Seamless onboarding and servicing Fast decisioning and funding Flexible, customisable lending

Lending doesn’t have to be complicated. Our modular platform gives you the ability to manage lending simply throughout the entire loan lifecycle, from application to collections. The result is a better experience for both borrowers and lenders.

-

CL Loan

Improve borrower experiences at scale with automated, cloud-based lending.

-

CL Collections

Maximize revenue with automated, agile, cloud-based collection processes.

-

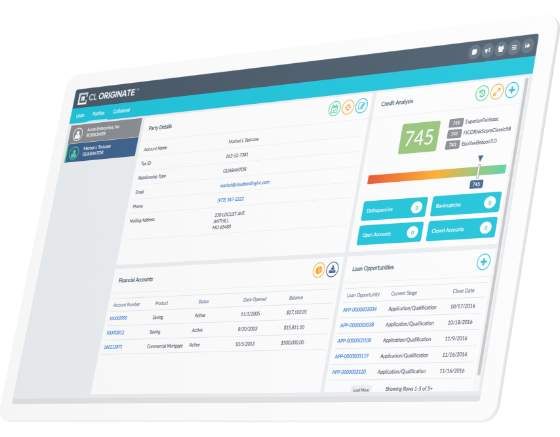

CL Originate

Increase productivity and lower origination costs with auto-decisioning and compliance checklists.

-

Product Overview

CL Marketplace

Expand your presence in online marketplace lending with an automated, comprehensive loan management tools.

-

CL Portal

Create great borrowing experiences with quickly configurable workflows and automated processes.

We’ve created a loan approval process that is 100% transparent. Cloud Lending also creates new efficiencies on the backend, allowing us to pass savings on to our customers, who are now getting superior experiences, competitive interest rates, faster payoffs, and no fees.

Origination made easy

Our leasing solution can be integrated with either your existing origination platform or our in-house origination and underwriting platform. With our solution, you’ll be able to set up online leasing portals and automate origination by gathering decisioning data from multiple sources and automatically generating contracts for e-signatures.

Integrate collections

Our modular approach to leasing and lending lets you plug into our agile collections solution, creating a seamless integration between collections and the rest of your leasing workflow. You’ll be able to simply define and automate your collections process, ensure your compliance team adheres to regulations, and provide a consistent lessee experience from start to finish.

BUT THIS IS JUST THE BEGINNING

Consumer Lending is just one piece of a comprehensive altfi solution set. Effectively serve account holders and transform their lives with our other altfi solution set.

Offer banking services without being a bank.

Don’t let outdated tech or compliance concerns stop you from building financial services products. Offer bank accounts, debit cards, and payments solutions without being a bank—or being forced to navigate banks’ legacy core processors and regulatory hurdles.

Opportunity awaits—but not for long.

The financial services market is quickly filling up with agile non-bank brands like yours, but there’s still room for you. We can help you seize this opportunity with solutions and partnerships designed to make it simple, fast, and inexpensive to win new customers, generate additional revenue, and build more rewarding customer relationships.

You can’t do it alone—but you won’t be.

Let’s build something better.

Or call +61 2 6536 2060