CL LOAN ™

Close more loans and reduce inefficiencies

Automate the loan process for retail and business borrowers

A configurable, end-to-end loan servicing application

CL LoanTM brings an exceptional borrower experience and lets you process more loans with fewer headaches.

KEY BENEFITS

INCREASE TRANSACTION VOLUME

Automating the loan cycle’s repetitive steps saves time and removes the errors and slowdowns that can significantly impact your process. Transaction volume will take off.MANAGE PORTFOLIOS EFFICIENTLY

As the number of portfolios you manage increases, CL Loan’s cloud-based approach provides scalability, secure storage, and easier document management.GREATER FLEXIBILITY

Quickly modify a variety of terms such as payment frequencies, interest structures, and delinquency grace days to help your borrowers stay on top of their finances.

We’ve gained complete, end-to-end lending with Cloud Lending. It’s made starting up so much smoother. We’re efficiently managing our lending while adding more customers without any issues.

IAIN PEPPER,

CEO STUDY LOANS

Learn Their Story

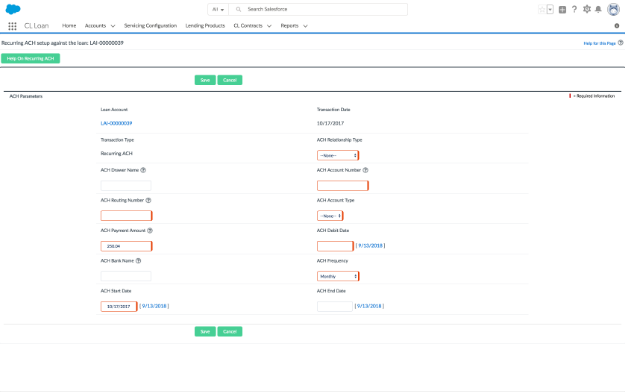

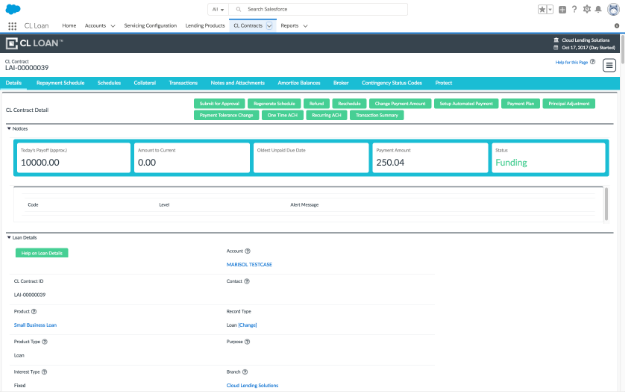

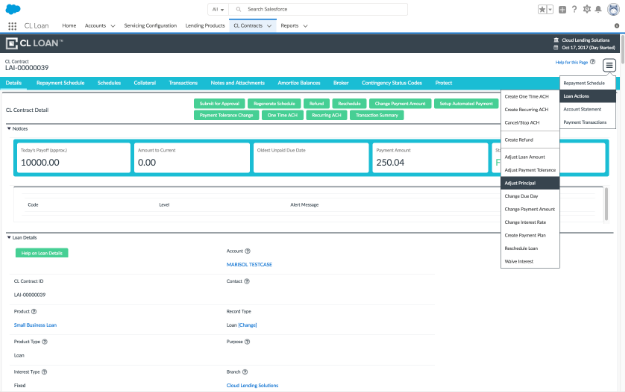

HOW IT WORKS

Single system of record

Manage every step of the lending cycle on a single, cloud-based system, including origination, underwriting, servicing, and collection.

Built natively on Salesforce

Integrate with thousands of other enterprise applications as you grow.

Enterprise-class security

As an AICPA SOC2 Type II certified company, protecting customer data is our #1 priority.