The new digital standard in asset finance.

Grow your business, boost margins and better serve customers with a configurable, cloud-based asset finance solution

The ground is rapidly shifting across the asset finance industry. In an always-on, 24x7 world, the savvy lessee expects a simple, quick and connected digital experience.

You can deliver all of this and more.

Here’s how.

SIMPLIFY EVERYTHING

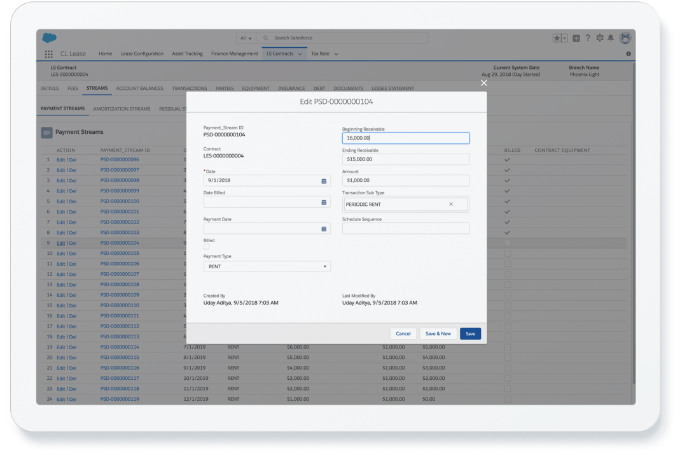

With nimble and configurable cloud technology it’s simpler and quicker to onboard customers, grow your business and efficiently manage margins.

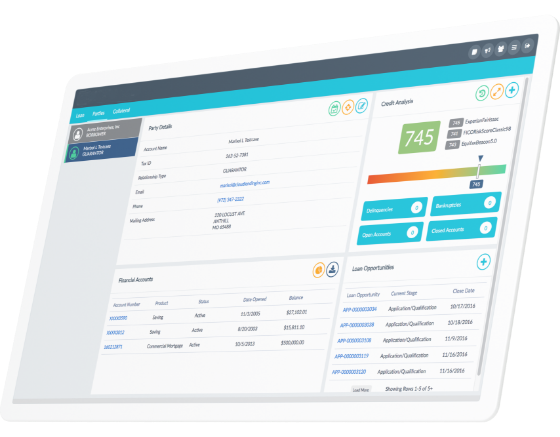

Build stronger relationships with data-driven insights

Keeping your focus on your clients will help you build the partnerships necessary to compete. With fully integrated onboarding and loan servicing processes, you can structure and deliver the deals that work best for you and your clients.Increase efficiency by interconnecting your business

Offer clients a streamlined and highly personalised experience. Our platform can integrate with systems throughout your organisation, empowering you to quickly and boldly adapt to customer needs and a competitive market.AGILE AND SCALABLE TECHNOLOGY

Configurable to suit unique requirements Scalable across diverse asset finance operations Multilingual, multi‑currency, multi-entity and multi‑location Access to a wide digital ecosystem Multichannel access for brokers and core staff Salesforce-native platform

Position yourself to offer the best and most relevant deals with our highly configurable, cloud-based, end-to-end lending software.

-

Product Overview

Q2 Portal

A great borrowing experience, configured by you. Offer a lending interface that suits your borrowers’ needs.

-

PRODUCT OVERVIEW

Q2 Origination for Lessors

Increase productivity and lower origination costs with auto-decisioning and compliance checklists.

-

PRODUCT OVERVIEW

Q2 Collections

Maximize revenue with automated, agile, cloud-based collection processes.

[Q2] is changing the way we engage with customers. Our customers want and expect a highly personalized experience. This platform means that our business and sales teams have the right tools and knowledge to respond quickly and intuitively, in order to deliver a tailored experience for all our customers.

Origination made easy

Our leasing solution can be integrated with either your existing origination platform or our in-house origination and underwriting platform. With our solution, you’ll be able to set up online leasing portals and automate origination by gathering decisioning data from multiple sources and automatically generating contracts for e-signatures.

Integrate collections

Our modular approach to leasing and lending lets you plug into our agile collections solution, creating a seamless integration between collections and the rest of your leasing workflow. You’ll be able to simply define and automate your collections process, ensure your compliance team adheres to regulations, and provide a consistent lessee experience from start to finish.

BUT THIS IS JUST THE BEGINNING

Asset Finance is just one piece of a comprehensive commercial solution set.

Effectively serve account holders and transform their lives with our other

commercial solution set.

Transform small businesses.

Applying for a business loan can feel daunting. The right deal can transform a business, helping them grow their team, land a game-changing contract or expand into new markets. The right software can ensure you’re offering the best possible deal, and help you build customer loyalty.

Turn complexity into opportunity.

Commercial loans can be complex, but they don’t have to be painful. Reduce complexity and increase visibility throughout the lending process with automated, configurable solutions. You’ll manage risk more precisely, close more loans faster and build better customer relationships.

Businesses need you now more than ever.

Help them navigate the changes happening all around them—and those that aren’t yet on their radar. They need you to be an agent of change.

You can’t do it alone—but you won’t be.

Let’s do this.

Or call +61 2 6536 2060